Online Banking & Bill Pay

Maintain access to your money wherever you are. Online banking and Bill Pay lets you view balances, transfer funds, set up recurring payments, and more — in just a few clicks. And there are no set hours to limit when you can bank. Simply log in whenever and wherever you are!

ONLINE BANKING & ADDITIONAL ONLINE SERVICES

Online banking benefits:

- Secure and easy-to-use service for Del-One FCU members

- Easily apply for loans or open new accounts

- Access and receive Mobile eStatements

- View account balances and history

- Transfer funds between Del-One accounts

- Link accounts from other financial institutions

- View checks written

- Make loan payments

More great online banking activities anytime, anywhere with internet access:

- Take advantage of advanced BillPay features & scheduling

- Explore new Alerts & Notification options such as “Budget Exceeded”, “Mobile Deposit Completed” or “Direct Deposit” (just to name a few!)

- Dispute transactions within your digital banking solution

- Savings goals – set and track savings goals

- Personal financial management and budgeting tools

- Shared Access – allows you to grant other users access to your accounts based on permissions given.

- Electronically “send cash” from your account to anyone’s account at another financial institution simply, securely, and in Real Time!

- Live Chat with a Del-One Representative. We can not only tell you but SHOW you how to use the system or answer any questions.

- Print or download to popular financial management software

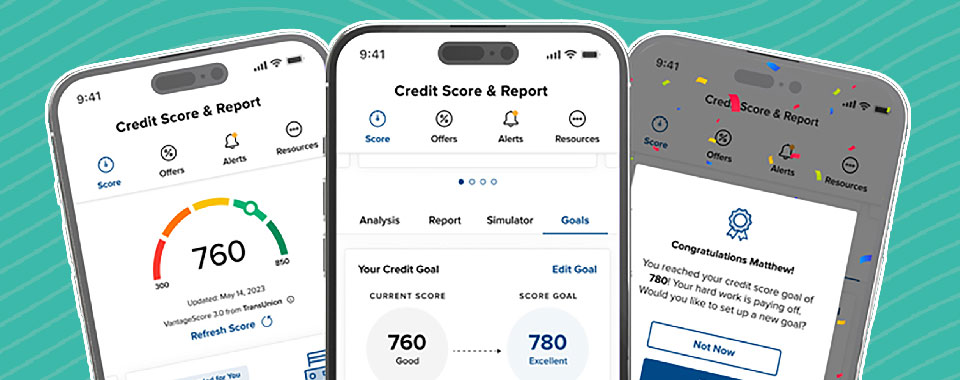

- Credit Score Monitoring with comprehensive score analysis, full credit report, and personalized offers with the Credit Score widget

- Monitor outside accounts with Account Aggregation – link your accounts from other financial institutions including Venmo, Robin Hood, etc.

- Transaction Data Enrichment – view simple transaction descriptions with categories that make using our budget tools easy and allows for more personal insights.

- Comprehensive Spending View with planned upcoming expenses

Save postage and time by paying one-time or recurring bills with ease through online Bill Pay:

- Schedule payments in advance

- Set up payment reminders

- Ensure payments are received on time

- Retain funds until paper drafts are presented for payment

A free, ongoing credit score report and monitoring program

- Master your credit standing

- Real-time security updates any time your credit file changes

- Access your score anytime and anywhere

- Personalized savings offers

From your online banking, you have access to our Personal Finance Manager. Benefits include:

- Convenient access to a view of all financial accounts

- The ability to track savings goals, budgets and spending

- Information and resources to make well-informed financial decisions

Rather than having your periodic statements sent through the mail, enroll in eStatements and:

- Save paper

- Receive email notifications when your eStatements are ready

- Reduce the chances of fraud and identity theft

- With a Rewards Checking or a Student Checking, enrolling in eStatements helps you to qualify for perks like ATM fee refunds!

To sign up for eStatements, login to your online banking account and click on Accounts > eDocs to subscribe.

Access your account anywhere and at any time through:

Need help getting started? Visit any of our branches or call us at (302)739-4496.

Mobile Banking

In today’s age of technology, there’s no reason you should have to run out to a branch just to do something simple, like depositing a check. Handle all of your banking activities right from your mobile device! You can review account history, transfer funds, receive alerts, and more.

MOBILE BANKING & ADDITIONAL MOBILE SERVICES

Mobile Deposit - Deposit checks from home!

- Deposit checks anytime, anywhere

- Save time, avoid unnecessary trips to a branch

- Available to members with a Del-One FCU checking account

*Maximum dollar amount per mobile deposit or per day is $5000. Savings bonds and foreign items are not eligible for mobile deposit. Funds are normally received within two business days. A business day is every day except Saturdays, Sundays, and federal holidays. Additional review may be required based on dollar amount. Please keep the paper check until the funds are posted to the account.

Mobile Wallet - Use your phone to pay!

Whether you are paying in a store or within apps, you can use Apple, Android, or Samsung Pay with your supported mobile device.

Contactless payment methods using your mobile wallet are secure: for every individual card transaction, there is a one-time, unique number that is communicated between the card and the terminal.

![]()

![]()

![]()

![]()

![]()

![]()

- Open your mobile wallet app and add your Del-One FCU card(s).

- While checking out in-store, look for the logos above to see if mobile wallet payments are accepted.

- Open your mobile wallet app and hold or wave your phone over the reader until the payment goes through.

Help us improve your mobile wallet experience! Use this form to report any issues you encountered while trying to use Apple Pay, Google Wallet, or Samsung Pay at a merchant or store. Your feedback is valuable in helping us enhance our services. Thank you!

P2P transfers - Easy person-to-person transfers

- Money moves directly from bank account to bank account

- All you need is an email address or mobile number to send/receive funds

Card Command - Your cards, on Your terms

- Receive alerts whenever your payment cards are used.

- Establish transaction controls for dollar amount limits, merchant categories, transaction types and geographic locations.

- Safeguard your cards: Turn them “off” if they’re misplaced or stolen and back “on” when you’re ready to use them.

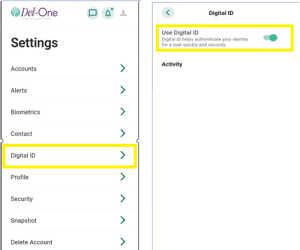

Enroll in Digital ID

Save time during calls and give your account an extra layer of security.

-

Enable Push Notifications for the Del-One app via mobile phone settings

-

Sign into the Del-One app

-

Navigate to “settings” then “Digital ID”

-

Slide toggle next to “Use Digital ID”

ONLINE & MOBILE BANKING FAQs

Do you offer Mobile Deposit?

How do I make a deposit with my phone?

Before you deposit your check, please ensure that the check is properly endorsed on the back. To endorse your check, sign your name on the lines provided on the backside of the check, then add “For Mobile Deposit Only” on the line below your signature.

To make a mobile deposit:

- Login to the Del-One app,

- Click on Deposit.

- You will be prompted to take a picture of the front and back of the check (place the check on a flat surface).

- Once you capture the image, you will be prompted to confirm the deposit amount.

- Select SUBMIT to confirm the amount deposited and submit the deposit.

The images are then enhanced and converted to a Check 21 compliant image for image exchange. The images are also validated to ensure image quality and the back of the check has been endorsed.

How do I change my address online?

To change your address online:

- Log into your account in online banking

- Select Tools, then Settings

- On the Contact tab, click the pencil icon next to Addresses

- Update the information and click SAVE

How do I reset my online banking password?

If you forgot your online banking password:

- On the online banking Log In page, click the Forgotten password? link.

- Click the the I Agree box to accept the Forgot Password disclosure and then Continue.

- Verify your identity by entering your Username, SSN/TaxID, Email, and one optional (Birth Date or Zip Code), click Continue.

- Enter New Password and Confirm New Password, click Save

If you are locked out and need a password reset, please call the Contact Center at 302-739-4496 during 8:00am – 6:00pm. Please have internet access when calling so that we can ensure you are able to login while a representative is on the phone with you.

What happens with mobile banking if my phone number changes?

If your mobile phone number changes:

- Go to Settings

- On the Contacts page, click the pencil icon next to the phone number, enter the new phone number and click Save Changes.

How can I change my Username for online banking?

If you know your username:

- Login to online banking

- Go to Tools, then Settings

- On the Security tab, select the pencil icon by Username to edit and then click Save Changes.

How do I change my password in online banking?

To change your password:

- Log into your account withing online banking

- Go to Tools, then Settings

- On the Security tab, click the pencil icon next to Password

- Enter Current Password, then enter & confirm New Password. Click Save Changes

If you don’t remember your password, click the Forgot password? link on the Login page.

How do I use Bill Pay to pay my bills?

- You only have to add the companies and people you want to pay once. The company or person remains in your list of bills until you delete the biller.

- You can make multiple payments at the same time from the Multiple Payments section.

- You can pay your bills from more than one payment account. However, you can select only one account at a time.

- When you enter an amount, Bill Pay automatically displays the earliest date the payee will receive the payment. You can accept this date or change it.

- Some payees let you make payments on the same day or the next business day.

- After you enter your payment information and click Next, we display it for review before you Confirm and Submit.

What kinds of transfers can I make?

The kinds of transfers you can do with Del-One FCU include:

- Immediate – a transfer that is attempted immediately

- One-time – a transfer that is made on the date you specify

- Automatic – a recurring transfer that occurs at your specified frequency as many times as you indicate

You can always do transfers within online banking and mobile banking under the “Transfer & Pay” tab.

Can I print my statement using Online Banking?

Yes! Find your printable bank statements in online banking

How do I turn on / off my cards with Card Command?

- Open your Card Command app

- Select the card you wish to make changes to.

- Select the “Card On/Off” toggle